Black Friday sales 2021: Data from 2,500+ eCommerce brands worth $219m

The Black Friday/Cyber Monday weekend is a crucial time of year for eCommerce businesses. It signals the start of the shopping season and is one of the most significant revenue-generating periods in the eCommerce calendar.

Across the BFCM weekend (November 26-29), businesses that use Wayflyer generated an incredible $219 million in revenue.

And we decided to dive into the data and see what we can learn about eCommerce in 2021 and the trends that might shape 2022.

Here’s what we found.

BFCM 2021: 3 key takeaways and learnings

1. Facebook ROAS declined 38% year-on-year

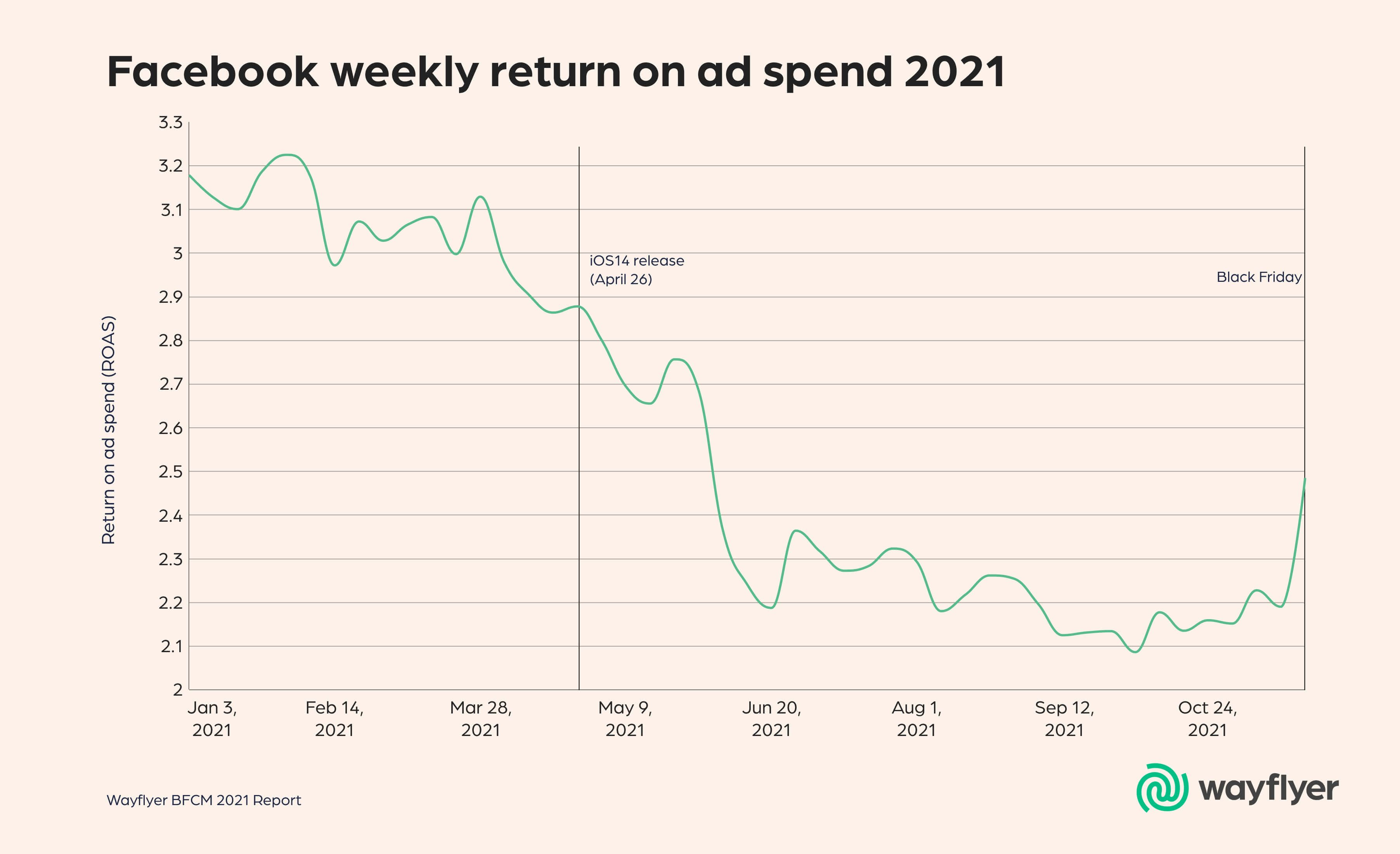

Apple's iOS 14 update wreaked havoc for advertisers on Facebook and Instagram, causing a steep decline in ROAS. Before iOS14, advertisers had an average ROAS of 3.07 from Facebook ads in 2021; post iOS14, this dipped to 2.31.

And the average ROAS for Facebook ads across the week of BFCM 2021 was 2.49, down from 3.43 during BFCM week a year ago — a 38% decrease.

Note: All Facebook data was sourced using a 7-day click 1-day view attribution window. And when we refer to 'Facebook ads,' we're talking about ads managed through Facebook Ads Manager (including Instagram ads).

Despite this, eCommerce businesses spent 5% more on average on Facebook ads this Black Friday week than last year, and the average Facebook ad spend was up 90% the week of Black Friday, versus year-to-date pre-Black Friday week.

So ROAS on Facebook continued to worsen and was down significantly year-on-year across BFCM, yet spending on Facebook was up.

This shows that eCommerce is still largely reliant on Facebook for growth, which could be a problem for your business.

If you're investing more money in advertising and your ROAS is down, this will have a knock-on impact as you'll likely have less cash on hand to buy inventory, and you'll be limited to how much you can invest in other areas of your business.

So maybe it’s time to take more of your budget to other advertising platforms? That question leads nicely on to our second takeaway from BFCM...

2. eCommerce businesses are investing more in Google ads

Though eCommerce businesses spent more money on Facebook ads over BFCM than last year, advertisers also appear to be looking outside Facebook for growth.

Ad spend on Google has gradually continued to gain market share over Facebook during 2021 — up 8% from early this year to the end of November, only slowing slightly during Back Friday week.

Before iOS14 was released (April 26th), 65% of budgets allocated to Facebook and Google ads went on Facebook. Since the update, that's dropped below 60%, and it hit a low of 56% before rising to 57% during the week of BFCM.

With advertisers seeing smaller returns on Facebook in 2021, ad budgets will likely continue to diversify during the holiday season and into 2022.

If you can identify some high-intent searches related to your business, Google Ads could be a great way to boost ROAS and become a little less reliant on Facebook.

Another channel you should consider is TikTok. Across BFCM, 15.3% of sessions generated from paid social channels came from TikTok, and we expect to see this number rise as more brands start to test out the platform's paid advertising capabilities.

3. It’s time to focus on building owned audiences

We found that fewer new customers are making purchases on Black Friday. In 2020, 60% of Black Friday purchases came from new customers, compared to 55% in 2021.

Coupled with lower ROAS, this could point to eCommerce businesses focusing more of their efforts (and budgets) on generating additional revenue from existing customers and putting slightly less emphasis on reaching new customers.

The drop in ROAS also highlights the importance of owning your audience and gathering first-party data throughout the year, ready to monetize in crucial moments like BFCM.

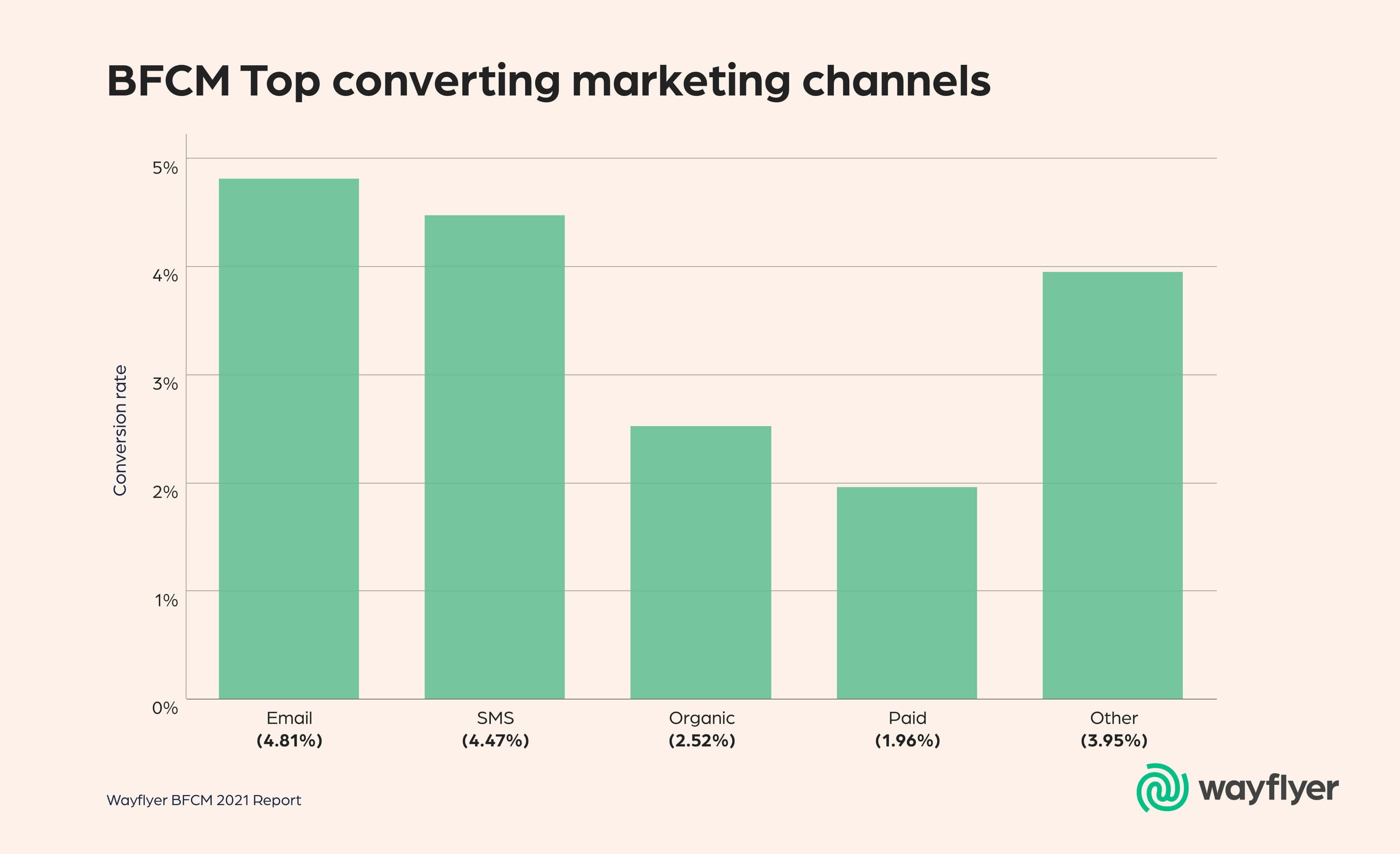

The two highest converting marketing channels during BFCM 2021 were email and SMS — both owned channels.

And to hit your growth goals in 2022, you need to start building audiences you don’t constantly have to pay to reach.

If you're wholly reliant on advertising for growth, you're essentially building your house on someone else's land — and the rules can change at any time (as we've seen with iOS14).

As you finalize your 2022 plans, think about how you can capture more first-party data and build audiences you connect with at any moment. An email list is a must; SMS is a huge opportunity too.

To start building owned audiences, you should:

- Ensure you have email or SMS opt-ins displayed on your website

- Invest in SEO and content to build your organic traffic (and the number of people who will see your opt-ins)

- Test out offers and discounts for joining your list

BFCM 2021 Data and benchmarks

Return on ad spend (ROAS) peaked at 4.2 on Black Friday

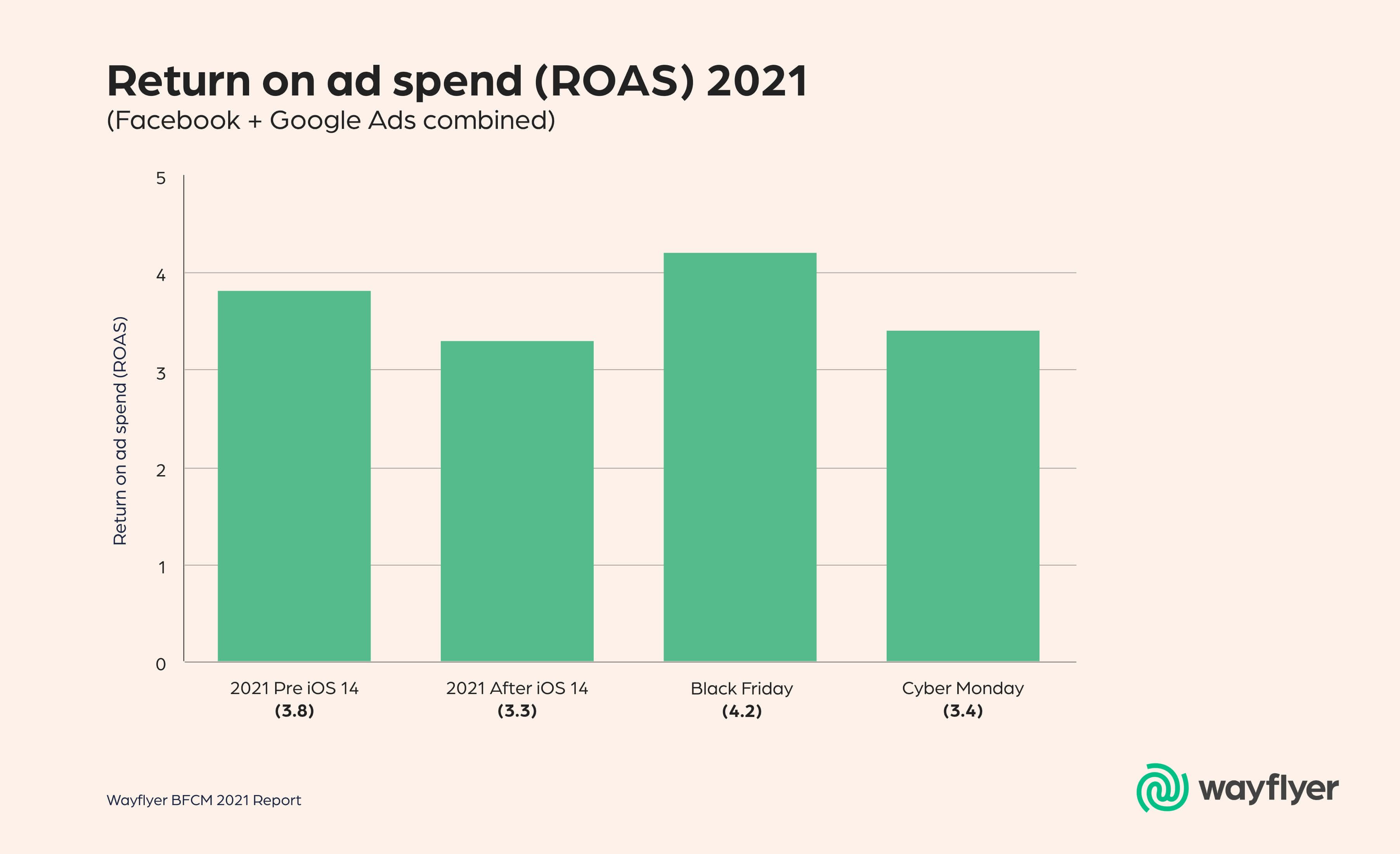

It’s impossible to discuss ROAS for eCommerce businesses without drawing a line in the sand when iOS14 came out.

After iOS14's release on April 26th, 2021, eCommerce merchants saw a decline in ROAS from 3.8 to 3.3 across Facebook and Google Ads.

However, on Black Friday, with customers primed and ready to buy, merchants saw a jump in ROAS to 4.2. On Cyber Monday, ROAS was just above the post-iOS14 average at 3.4.

Note: All Facebook data was sourced using a 7-day click 1-day view attribution window.

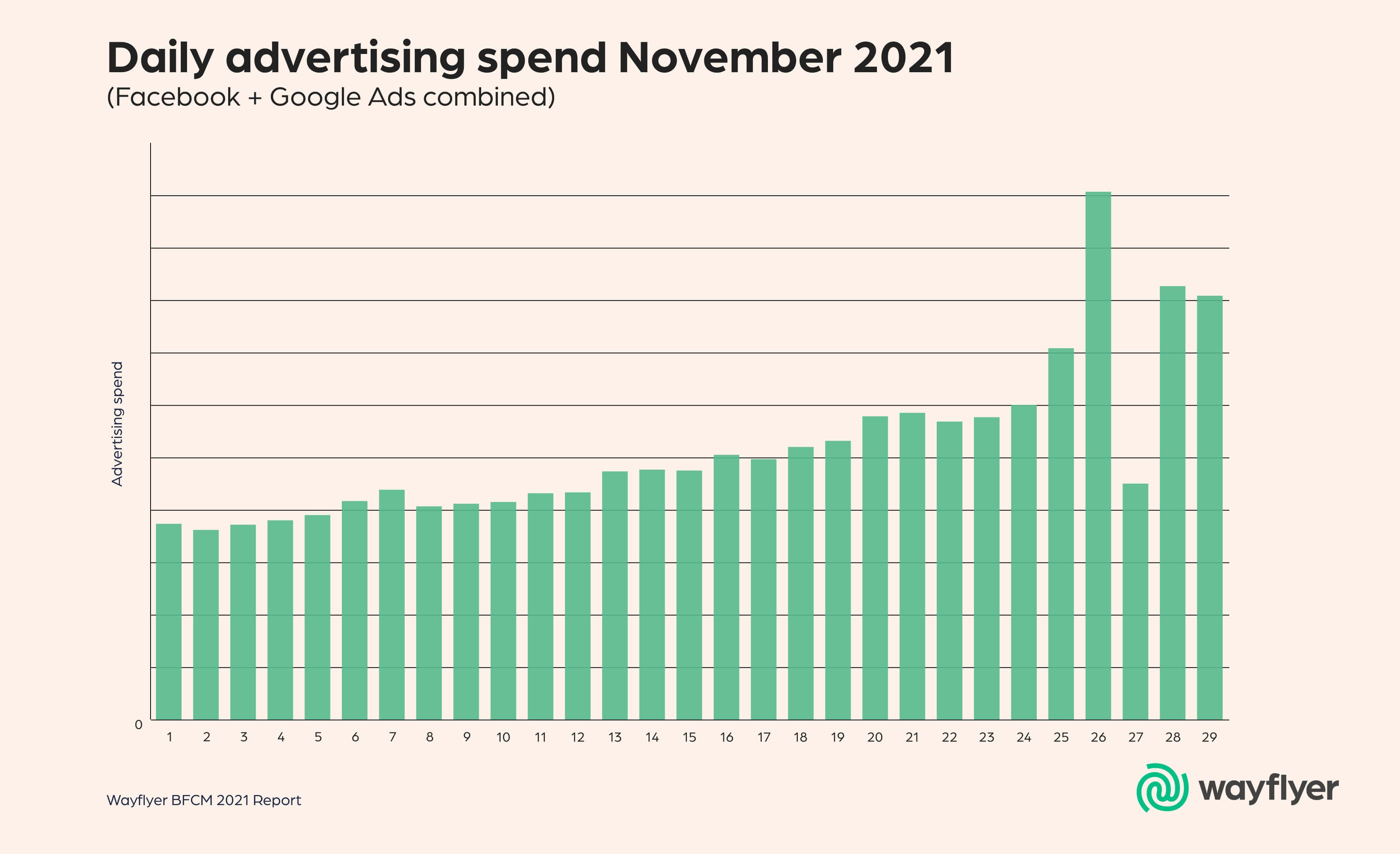

Ad spend started to increase around mid-November

The BFCM weekend is transforming into an almost month-long event. Ad spend still peaks for eCommerce businesses on Black Friday, but from looking at ad spend across the whole of November, you can start to see spending increase a little more dramatically from around the 12th/13th/14th of the month.

It’s also interesting to note that ad spend dips significantly on the 27th and ramps up again on the 28th and 29th (Cyber Monday).

As consumers become more expectant of BFCM sales, you could try getting ahead of the game by starting sales and increasing ad spend earlier in November.

You could also create content and campaigns that build excitement about your BFCM offers in the build-up to the weekend so that your existing customers (and any new audiences you're moving through your funnel) are ready to buy when Black Friday rolls around.

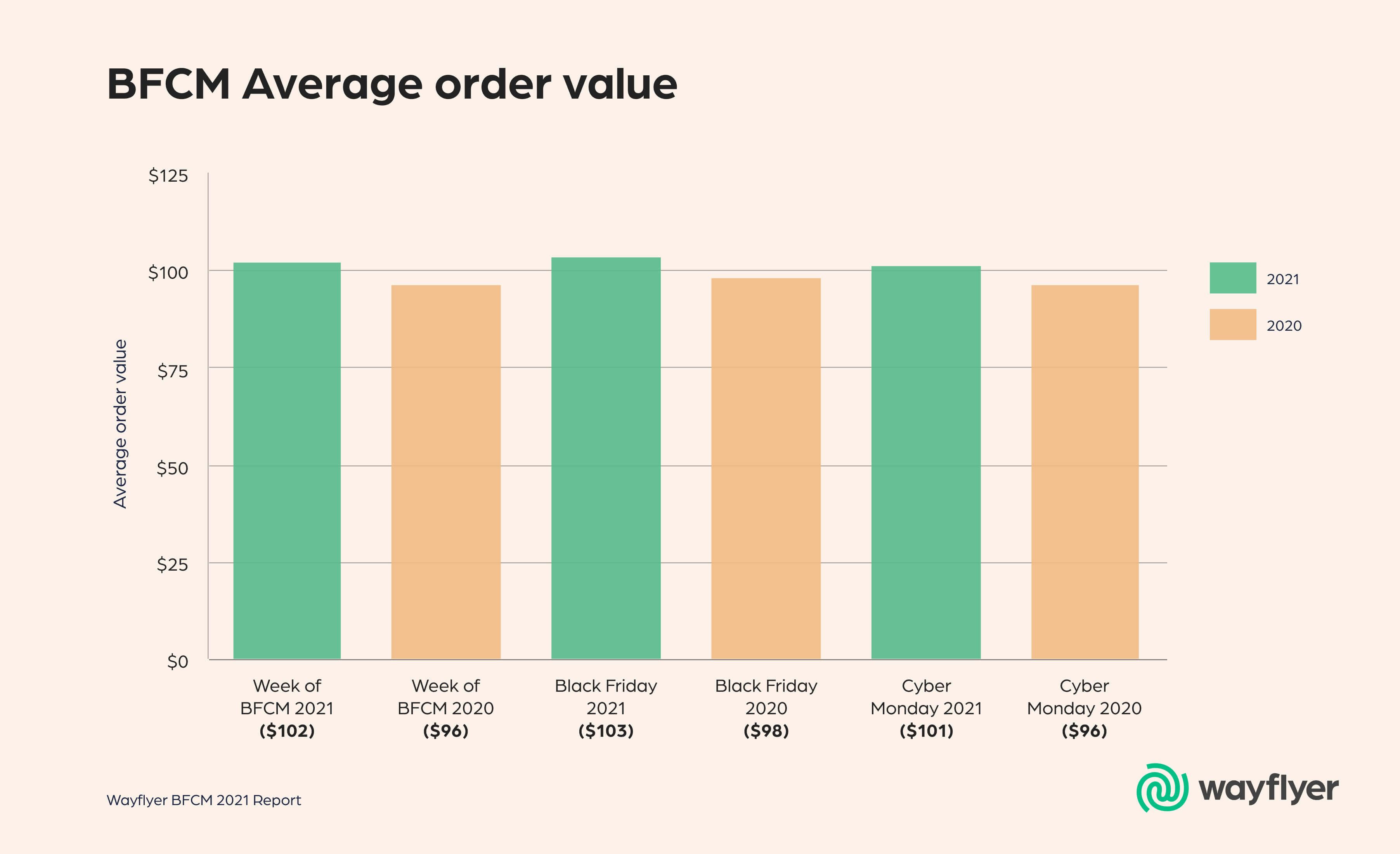

Average order value increased year-on-year

The average order value per customer (AOV) went up across Black Friday/Cyber Monday when compared to the same period in 2020. Across the week of Black Friday/Cyber Monday, the average order value was $102 in 2021, up $6 from 2020's AOV of $96.

So despite the frequent heavy discounting, it appears that BFCM is an excellent time for eCommerce businesses to run promotions aimed at increasing the number of products sold in each transaction.

Instead of focusing solely on discounting, you could also try creating bundles for BFCM to increase the number of products sold in each sale. Offers like 'buy two get one free' are also an excellent way to encourage customers to spend more.

Website conversion rate increased the week of BFCM but fell below 2020’s benchmarks

Customers are ready to spend money across BFCM weekend, so they're likely heading to eCommerce sites with a higher intent to purchase.

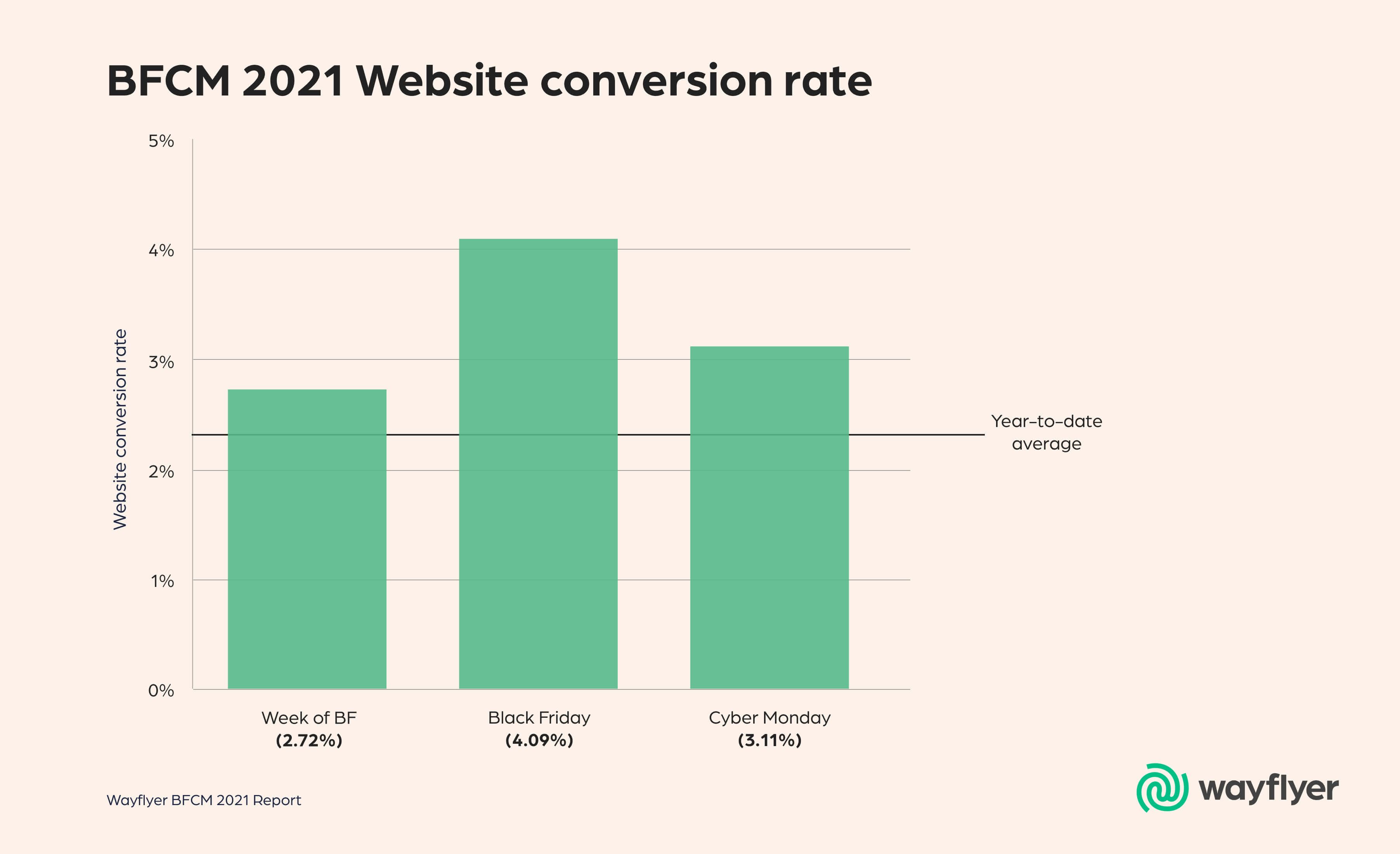

Our data shows that the conversion rate for eCommerce sites increased compared to 2021's average of 2.31%.

The week of Black Friday, the average website conversion rate was 2.72% — this jumped to 4.09% on Black Friday and 3.11% on Cyber Monday.

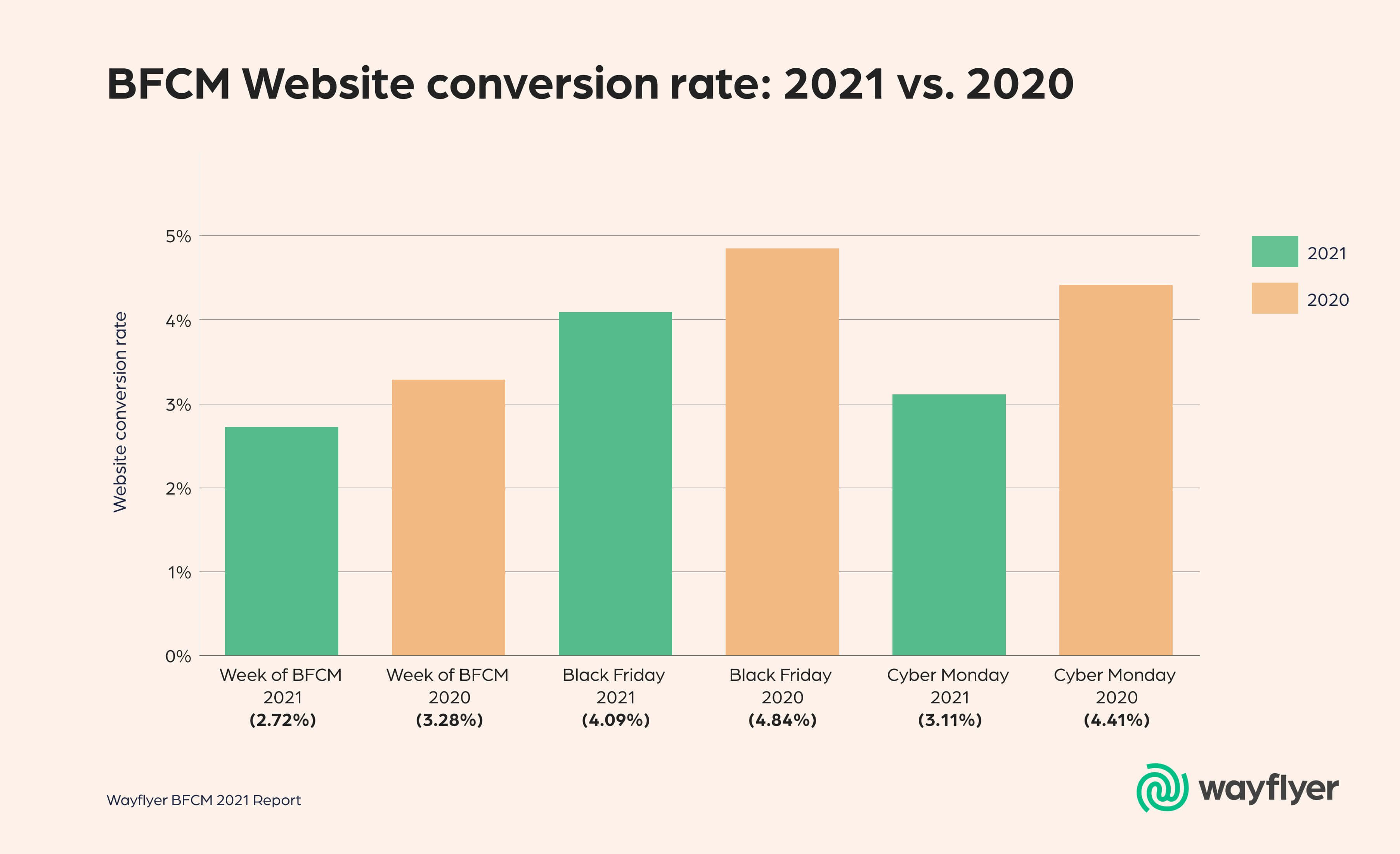

However, it seems it isn't as easy to convert customers across the Black Friday weekend now as 2021's conversion rates were lower than 2020's. Below you can see a comparison of 2021's conversion rates vs. last year:

Sites in our dataset also saw an increase in traffic across the BFCM weekend. On average, traffic was up 37% on Black Friday and 21% on Cyber Monday compared to the average number of daily sessions across the rest of November 2021.

A lower percentage of orders came from new customers in 2021

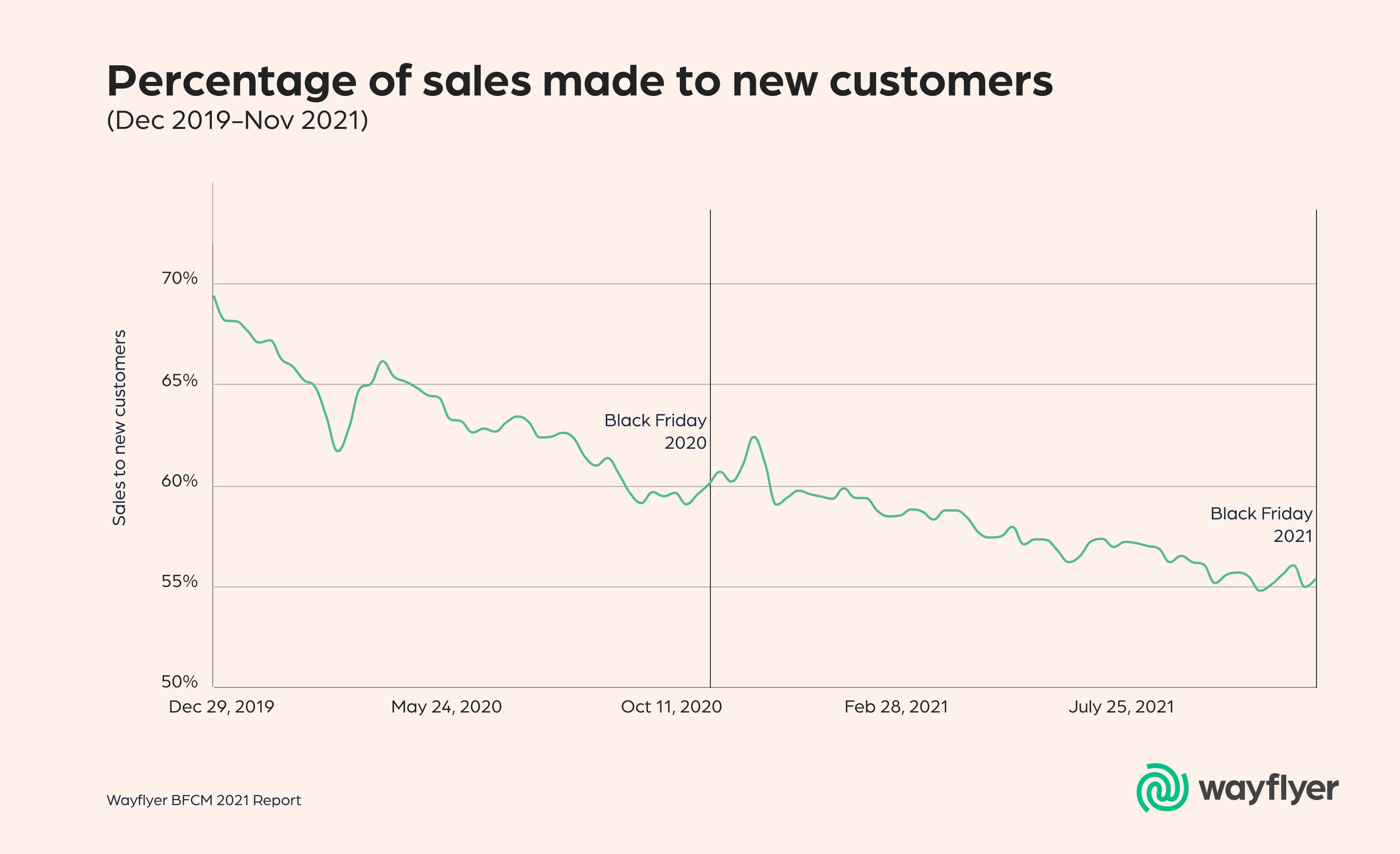

During the week of BFCM 2021, 55% of purchases came from new customers, and on Black Friday and Cyber Monday, specifically, the percentage of purchases attributed to new customers were 55% and 54%, respectively.

Our data shows that fewer new customers made purchases across BFCM 2021 compared to 2020, where 60% of purchases were made by new customers across the week, with 59% of Black Friday sales and 59% of Cyber Monday sales going to new customers.

Sites in our dataset also saw an increase in traffic across the BFCM weekend. On average, traffic was up 37% on Black Friday and 21% on Cyber Monday compared to the average number of daily sessions across the rest of November 2021.

A lower percentage of orders came from new customers in 2021

During the week of BFCM 2021, 55% of purchases came from new customers, and on Black Friday and Cyber Monday, specifically, the percentage of purchases attributed to new customers were 55% and 54%, respectively.

Our data shows that fewer new customers made purchases across BFCM 2021 compared to 2020, where 60% of purchases were made by new customers across the week, with 59% of Black Friday sales and 59% of Cyber Monday sales going to new customers.

The decline in new customers could be attributed to the growth of eCommerce as a whole since the beginning of the COVID-19 Pandemic — both in terms of the number of consumers shopping online and the number of eCommerce stores online.

In early 2020, over 60% of sales tracked by Wayflyer were to new customers, but that number has declined as more shoppers are now becoming returning customers.

This decline could also signify that eCommerce businesses are getting better at marketing to existing customers — something that feels evident when you see the two highest converting marketing channels below…

Email was the highest converting marketing channel

Email is a mainstay of digital marketing. And in 2021, it again proved its value to eCommerce businesses as the highest converting marketing channel across the BFCM weekend.

It's much easier to make a sale to an existing customer or warm prospect on your email list, so it makes sense that this would be the highest converting channel.

Email marketing had a conversion rate of 4.81% across the BFCM weekend, driving 8.35% of sessions and 11.7% of revenue.

So, in short, you should double down on email marketing. Focus on building email lists that you can monetize during busy, sales-heavy periods of the year like BFCM and the holiday season.

Across the year, try running giveaways, experimenting with pop-ups and CTAs across your site, and offering discounts for joining your mailing list to encourage growth ready for the shopping season.

The second highest converting channel was SMS (4.47%). The number of businesses taking advantage of SMS is much smaller than other channels, though — across the BFCM weekend, SMS was only responsible for 1.06% of sessions on eCommerce sites and generated just 1.5% of revenue.

If you're looking for a new channel to test out in 2022, SMS could be a massive opportunity for your business. It also doesn't need a huge upfront investment to get started.

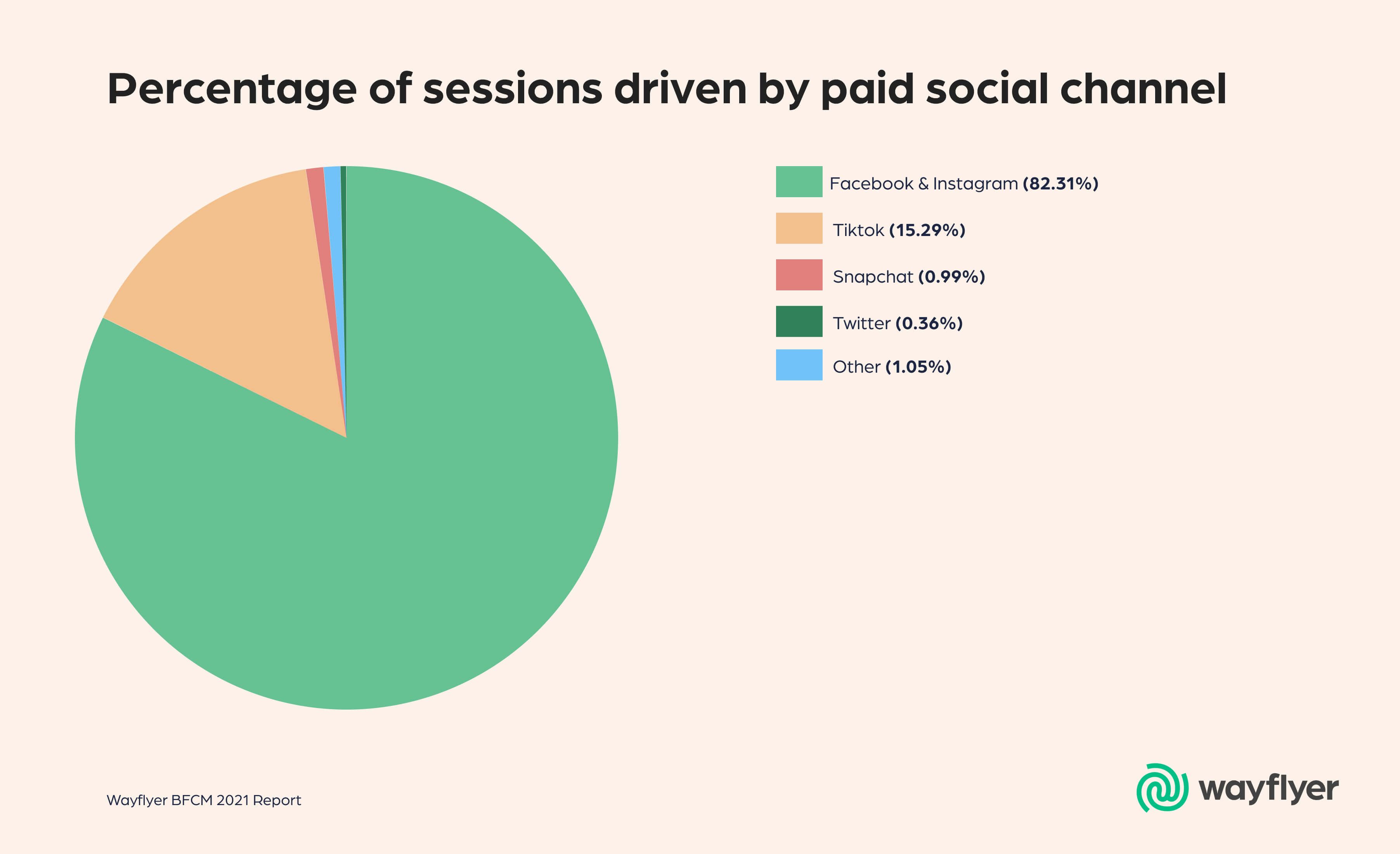

Facebook and Instagram generated the most traffic from paid social channels

Facebook is still the dominant player when it comes to driving website traffic from paid social channels. Facebook and Instagram were responsible for 82.31% of traffic from paid social channels across BFCM 2021, with TikTok (15.29%) in second and Snapchat third (0.99%).

As we noted earlier, it appears that advertisers are looking to diversity their ad spend away from Facebook. And in 2022, we expect to see a more significant number of advertisers testing budgets with platforms like TikTok and Snapchat.

When it comes to managing your advertising budget in 2022, it's worth ensuring there's space for experimentation. One of the best ways to do this is by using the 70:20:10 model, and here's how you can apply it to ad budgets:

- Focus 70% of your budget on 'safe' channels that you've validated and know will generate reasonably predictable returns

- 20% on slightly risky channels where the returns will be a little more unpredictable

- 10% is for home run swings — the channels that feel a little more risky and unproven but could generate big returns if you get it right

If you're not constantly experimenting and learning, you won't reach your potential, and you'll be more susceptible to platform changes out of your control.

For example, eCommerce businesses that had started to validate TikTok ads before iOS14's release were able to move more of their budgets away from Facebook faster than brands that were 100% reliant on Facebook's adverting platform.

Are you planning for BFCM 2022?

Thanks so much for checking out our BFCM data. And I hope you've found some time to pause and celebrate your achievements across BFCM this year.

Building an eCommerce business isn't an easy path to follow, and sometimes we all need to look back and realize how far we've come.

But as always in eCommerce, the next challenge isn’t too far away.

We're heading into the holiday season. And realistically, we're not too far from having to plan out inventory for BFCM 2022.

We've heard some businesses are looking to place BFCM inventory orders in April next year due to the current supply chain issues, maybe even earlier.

If you’d like to discuss your plans for 2022 — whether it’s inventory planning, how to manage marketing spend, or anything else you have on your mind, we’re always keen to chat.

About the data: Wayflyer's Black Friday/Cyber Monday 2021 data is based on sales, traffic, and ad spend data from more than 2,500 eCommerce businesses in over ten countries, sourced from Wayflyer's analytics platform. All financial figures are adjusted to USD. All data is aggregated and anonymized.