Why wait? Receive your pending store revenue now

4.7 stars 400+ reviews | GDPR and SOC II Compliant

FDIC insurance up to $3M for funds on deposit via Thread Bank1. Pass-through deposit insurance coverage is subject to conditions.

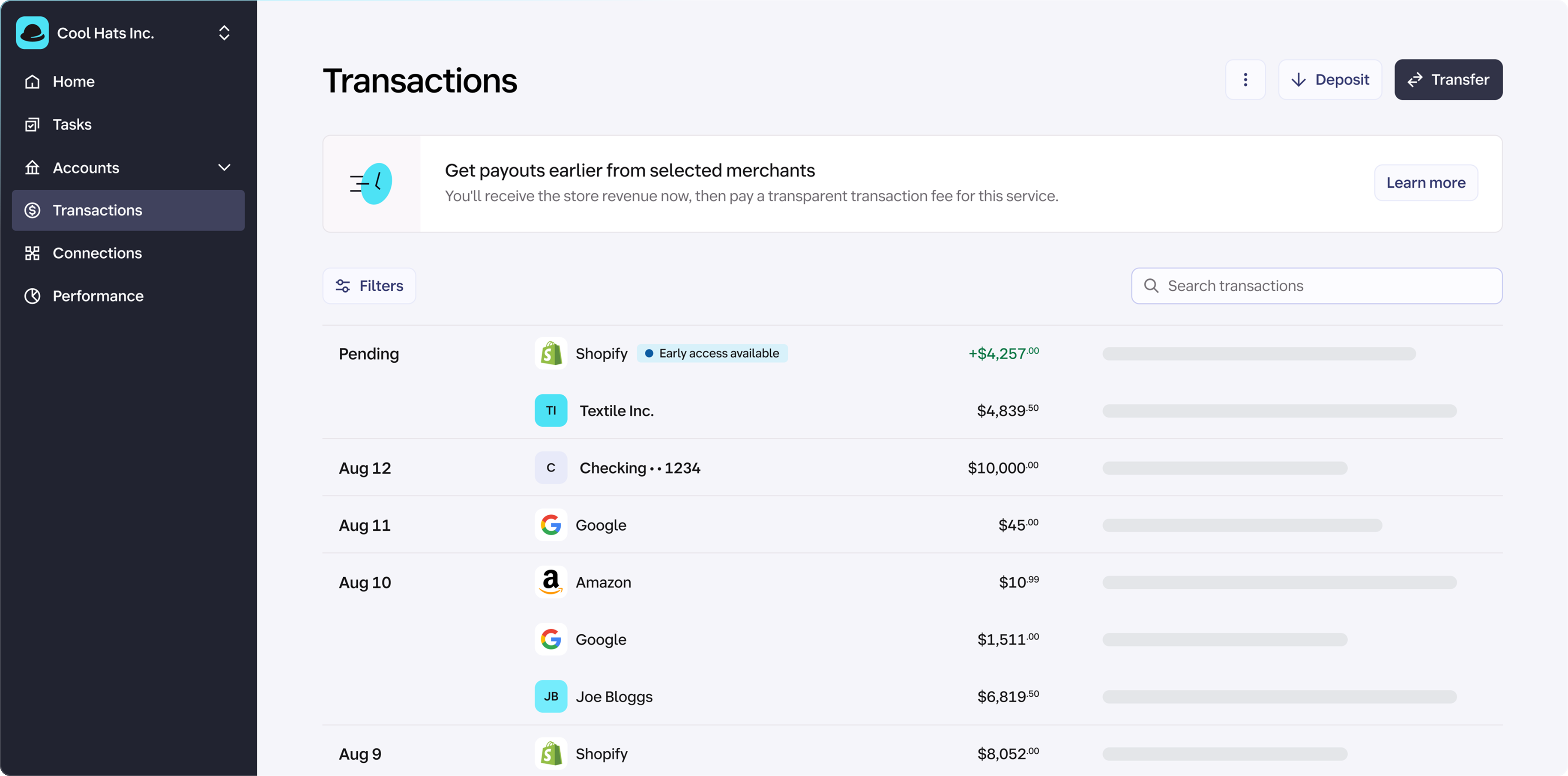

Payout pending?

Receive it early.

Set up an account in minutes to access Shopify or Amazon payouts early.

1. Open an account

2. Accept an offer

3. Receive the funds

Purpose-built for brands like yours

Wayflyer |

|---|

Deep consumer brand expertise |

2.68% Annual Percentage Yield (APY)2 |

Seamless online application |

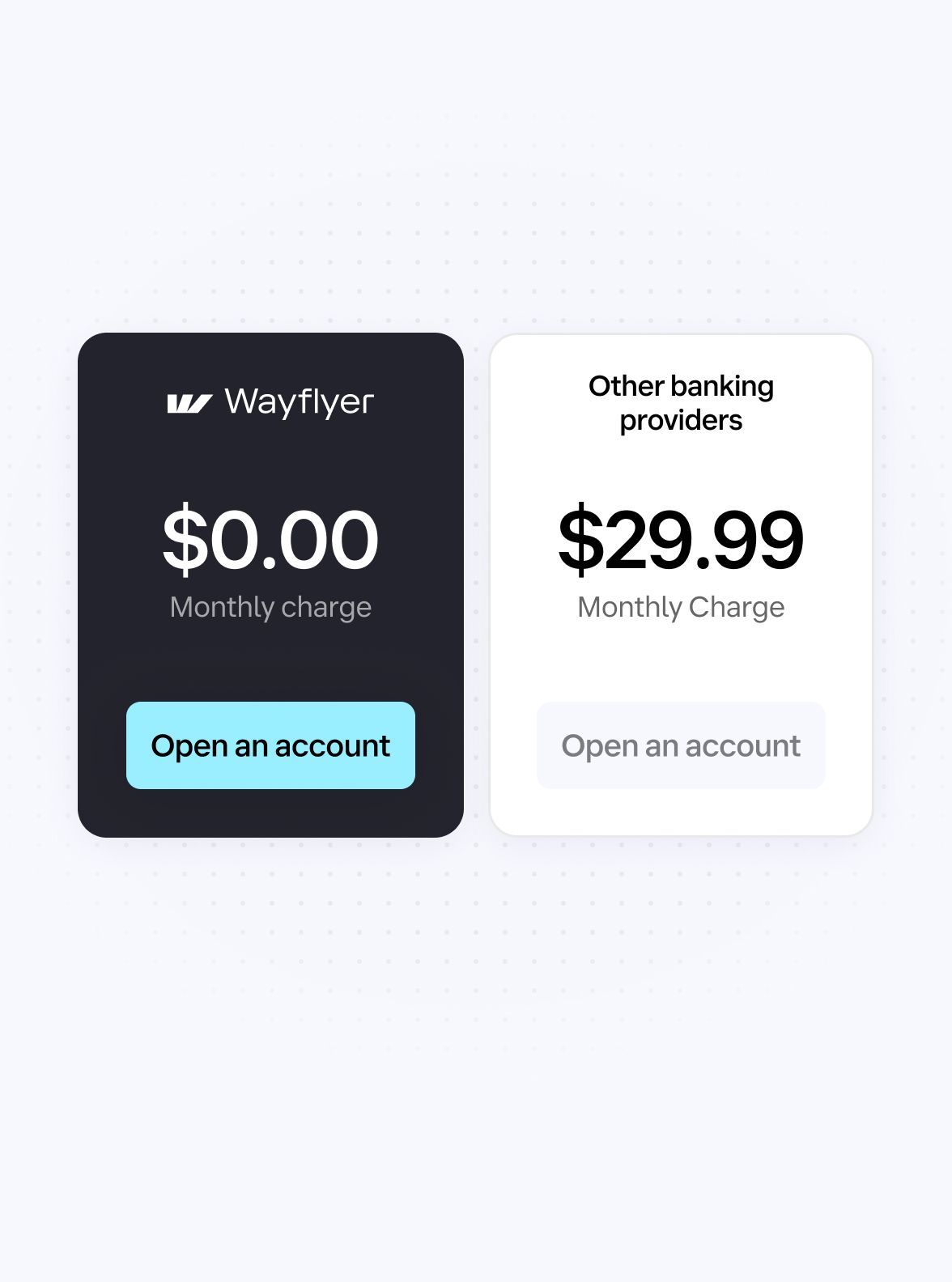

No setup or monthly maintenance fees |

Dedicated account support |

Traditional banks |

|---|

Broader industry focus |

Often less than 0.1% APY, with balance requirements and limits |

May require in-person application |

Setup and monthly maintenance fees ($20 on average) |

Limited account support |

Receive financing. Pay suppliers. Earn interest.

All from one account.

Receive financing instantly1

Access best-in-class financing at discounted rates, disbursed straight into your Wayflyer account.

Send payments easily

Pay suppliers at the click of a button via free ACH payments or $10 wire transfers.

Earn 2.68% APY on all deposits2

Our interest is paid on all checking deposits, with no minimum balance requirements or tiering.

Built-in peace of mind

No monthly fees or setup costs

Accounts can be opened in minutes. It's a no-brainer to get started.

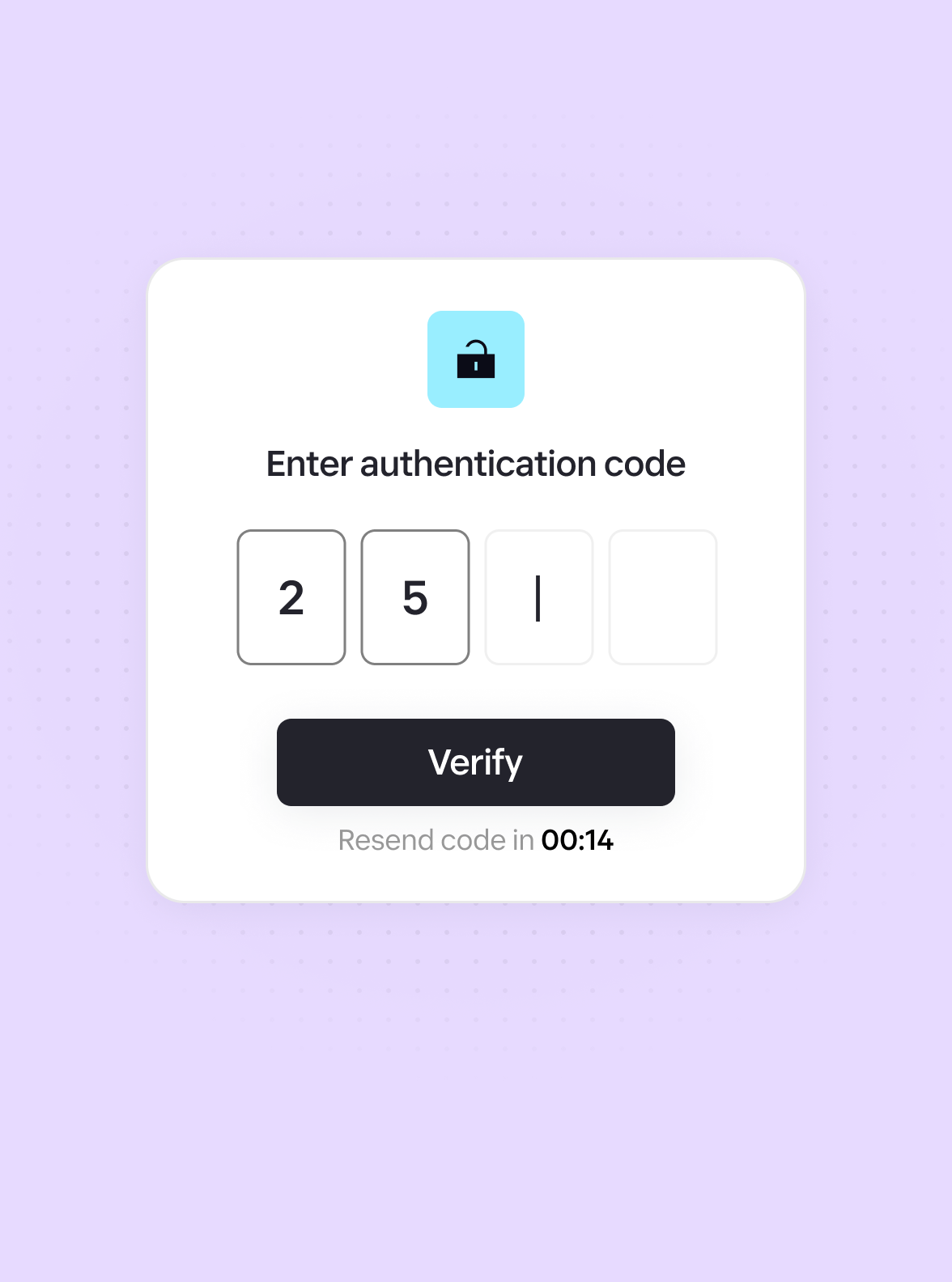

Robust access controls

We offer multi-factor authentication, user-level permissions and ongoing fraud monitoring.

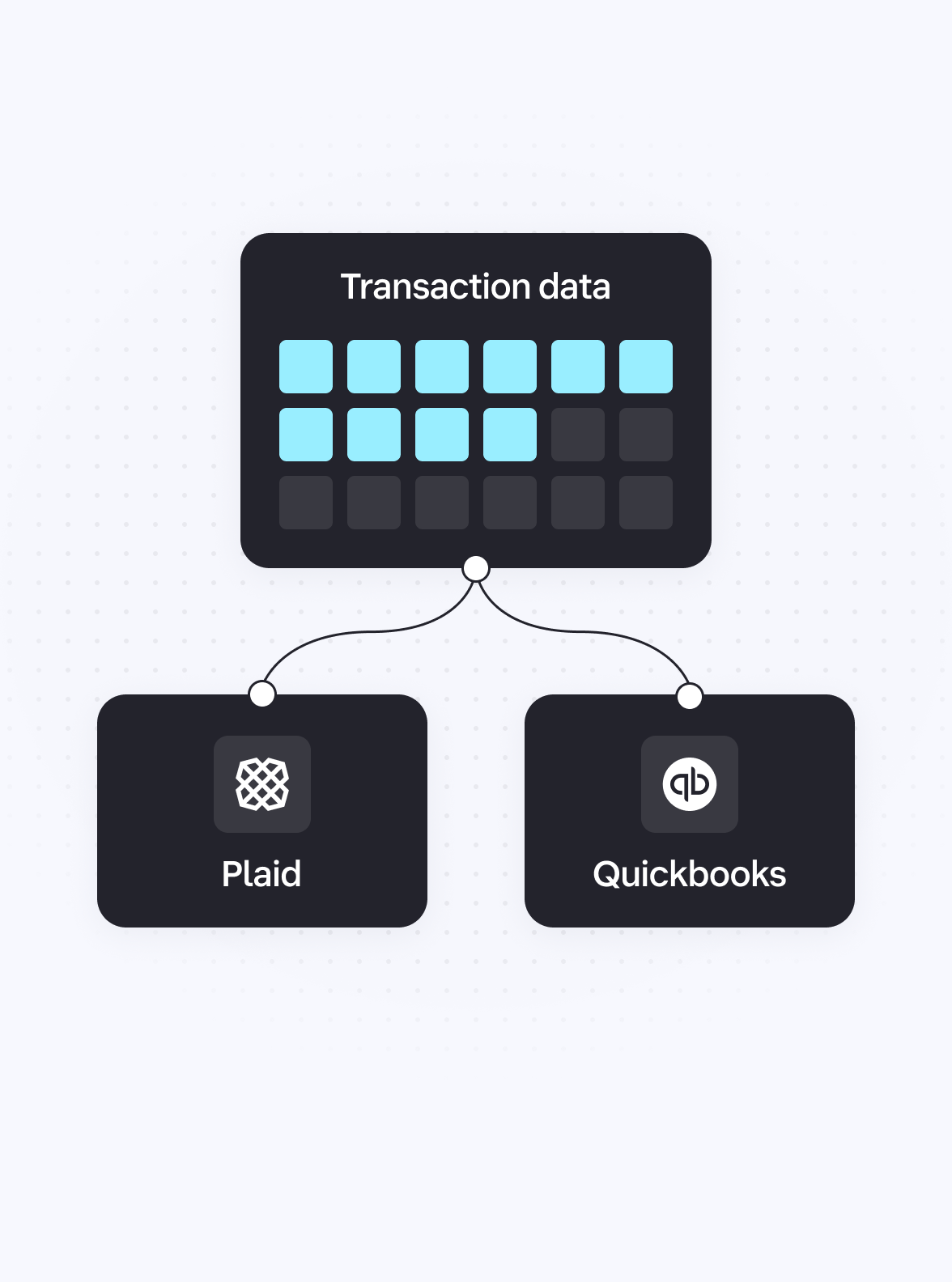

Accounting integrations

Connect transaction data to Plaid and Quickbooks for meticulous bookkeeping.

Dedicated account support

Get rapid responses to support queries and an account manager for financing questions.

Frequently asked questions

Receive your pending store revenue today

It takes less than 10 minutes to get started.