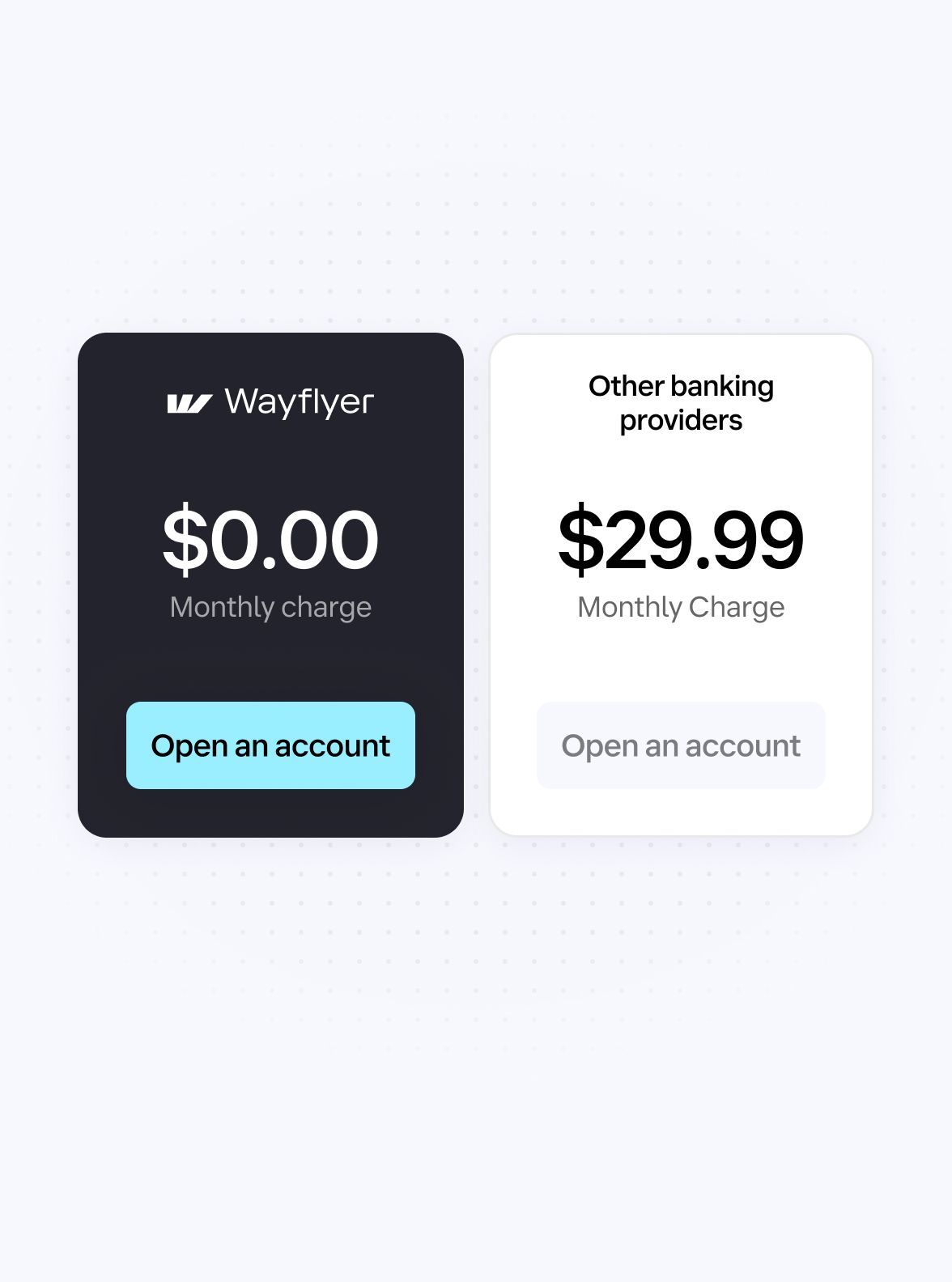

No monthly fees or setup costs

Accounts can be opened in minutes. It's a no-brainer to get started.

4.7 stars 400+ reviews | GDPR and SOC II Compliant

FDIC insurance up to $3M for funds on deposit via Thread Bank1. Pass-through deposit insurance coverage is subject to conditions.

Access best-in-class financing at discounted rates, disbursed straight into your Wayflyer account.

Pay suppliers at the click of a button via free ACH payments or $10 wire transfers.

Our interest is paid on all checking deposits, with no minimum balance requirements or tiering.

Accounts can be opened in minutes. It's a no-brainer to get started.

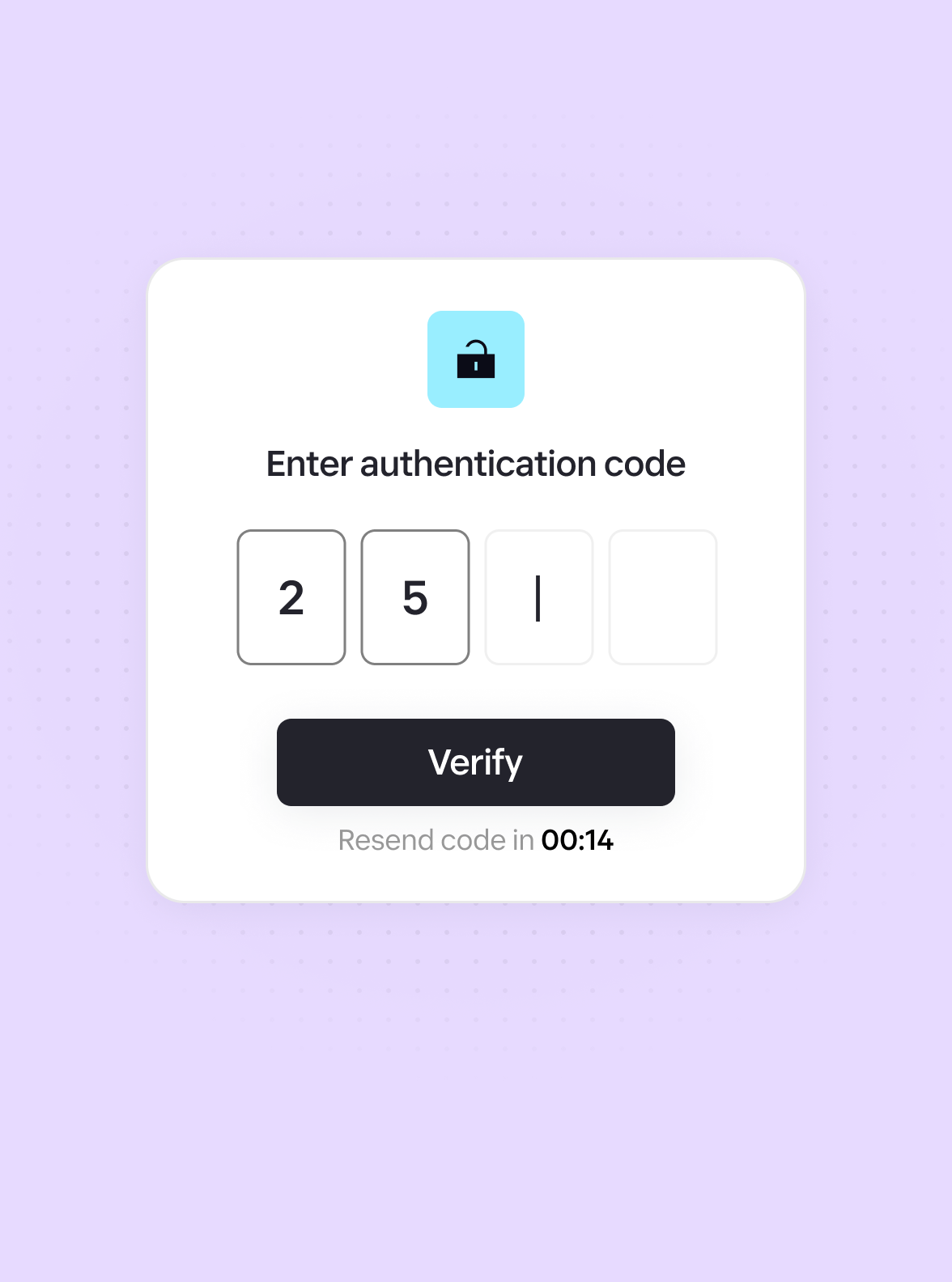

We offer multi-factor authentication, user-level permissions and ongoing fraud monitoring.

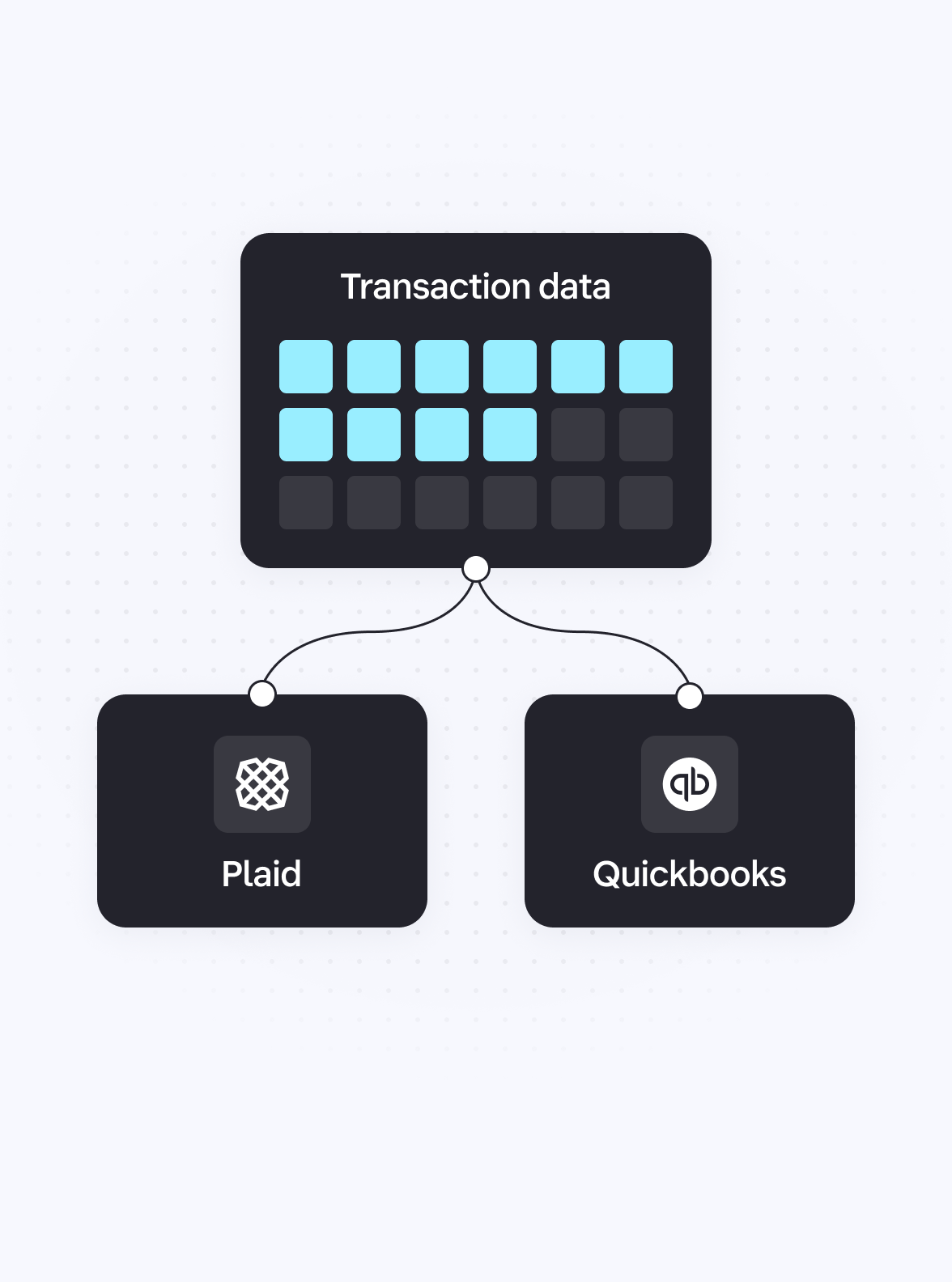

Connect transaction data to Plaid and Quickbooks for meticulous bookkeeping.

Get rapid responses to support queries and an account manager for financing questions.

Wayflyer |

|---|

Deep consumer brand expertise |

2.50% APY2, with no minimum balance requirements |

Seamless online application |

No setup or monthly maintenance fees |

Dedicated account support |

Traditional banks |

|---|

Broader industry focus |

Often less than 0.1% APY, with balance requirements and limits |

May require in-person application |

Setup and monthly maintenance fees ($20 on average) |

Limited account support |

It takes less than 10 minutes to get started.

Wayflyer is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC. FDIC insurance covers the failure of an insured bank. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. The Wayflyer Visa® Debit card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.