How your cashflow statement vs P&L interplay

Key takeaways

- Even with great margins, making more sales isn't necessarily a good thing if working capital isn't managed well.

- Your profits in a given period don't actually reflect the flow of funds. There's a timing mismatch between your P&L and cash flow statement.

- You don't die in your P&L. You die in your cash flow statement.

Recognize the importance of strong working capital management

In previous articles, we've explored ways to improve your profit and loss (P&L) statement. Let's assume you've taken steps to improve your unit economics, with a strong contribution margin on each sale.

Now here's a harsh reality to follow: Even with great margins, making more sales isn't necessarily a good thing if working capital isn't managed well. Turnover is vanity. Profit is sanity. Cash is reality.

Working capital represents the capital required to finance your day-to-day operations, like ordering inventory, investing in marketing, or paying wages. It's essentially the cash trapped in the operating cycle.

And strong working capital management is an underrated technique that great eCommerce operators do well. It's as important to your business as your unit economics.

working capital = current assets - current liabilities

Look at how the financial statements interplay

It's crucial to have an intimate understanding of how the P&L statement, balance sheet and cashflow statement interplay.

You need to be able to follow the money as it passes through your financial statements and into (or out of) your bank account.

You can be profitable on your P&L each month and still have no dollars in your pocket. That's because the figures on a P&L don't actually reflect the flow of funds.

There's a timing mismatch. Revenue, expenses and profits hit the P&L based on accrual accounting - i.e., "when they are incurred" - and not when cash actually changes hands.

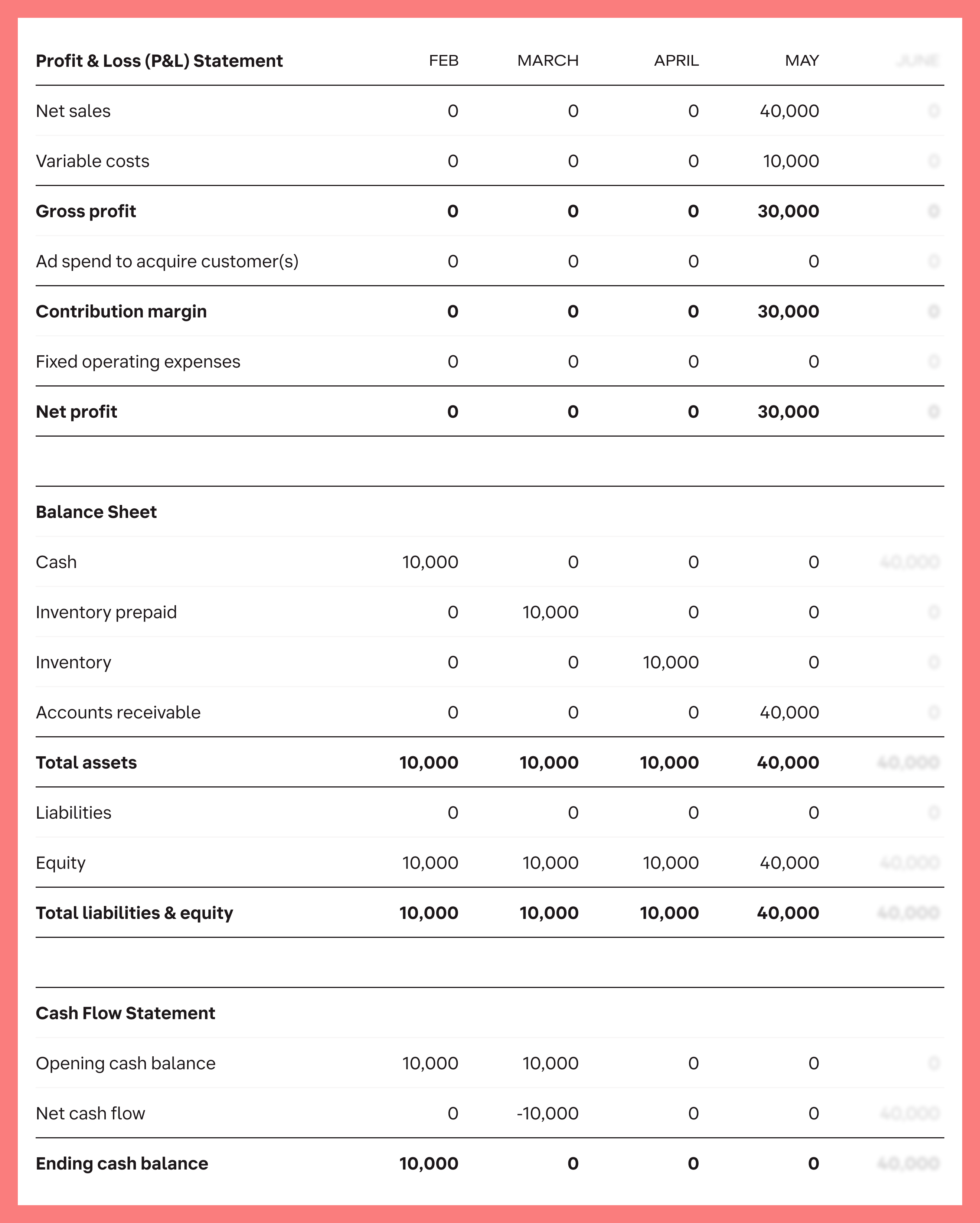

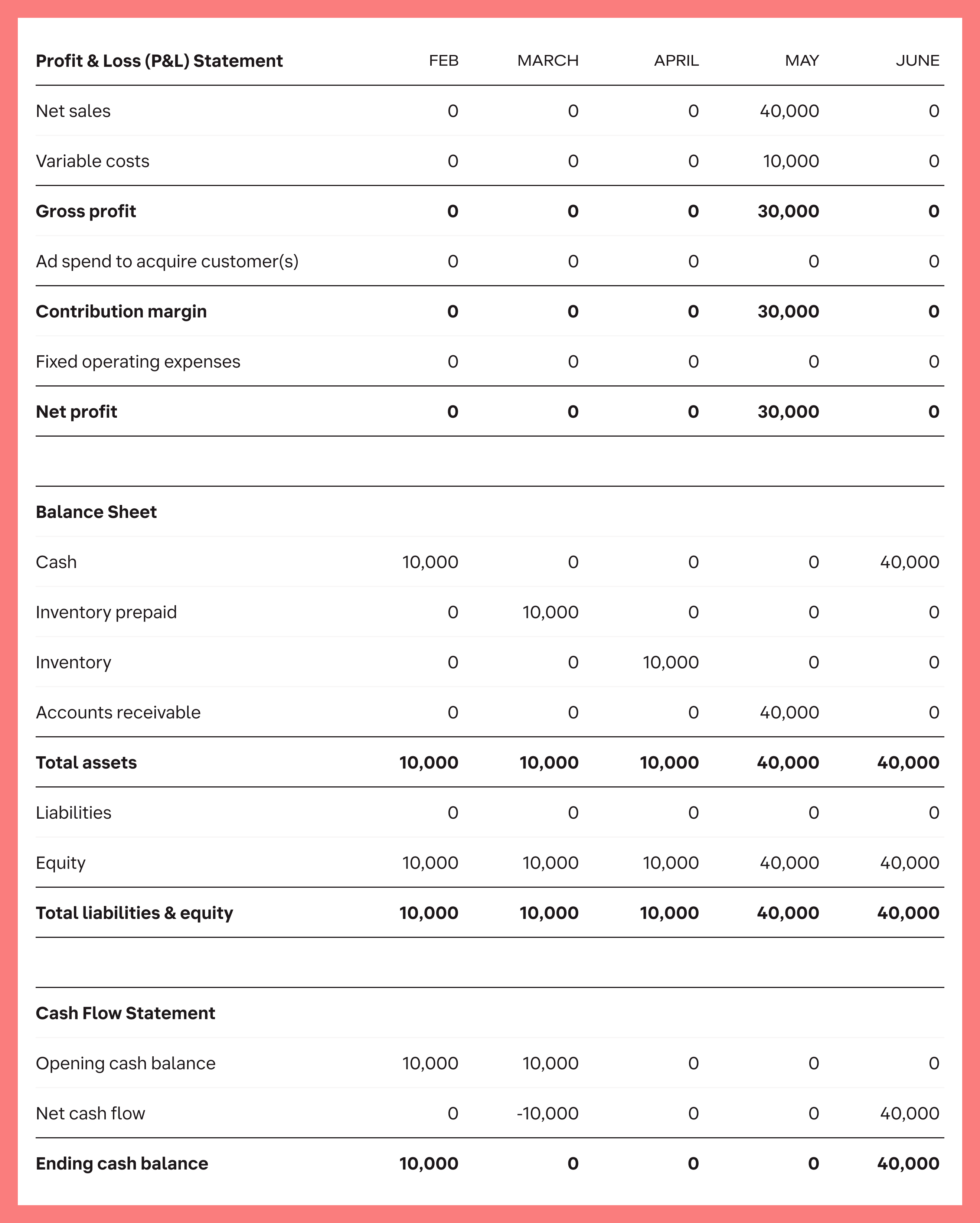

Let's run through an example to bring this concept to life. For the purposes of being able to "follow the money" through your financial statements, we'll keep it simple.

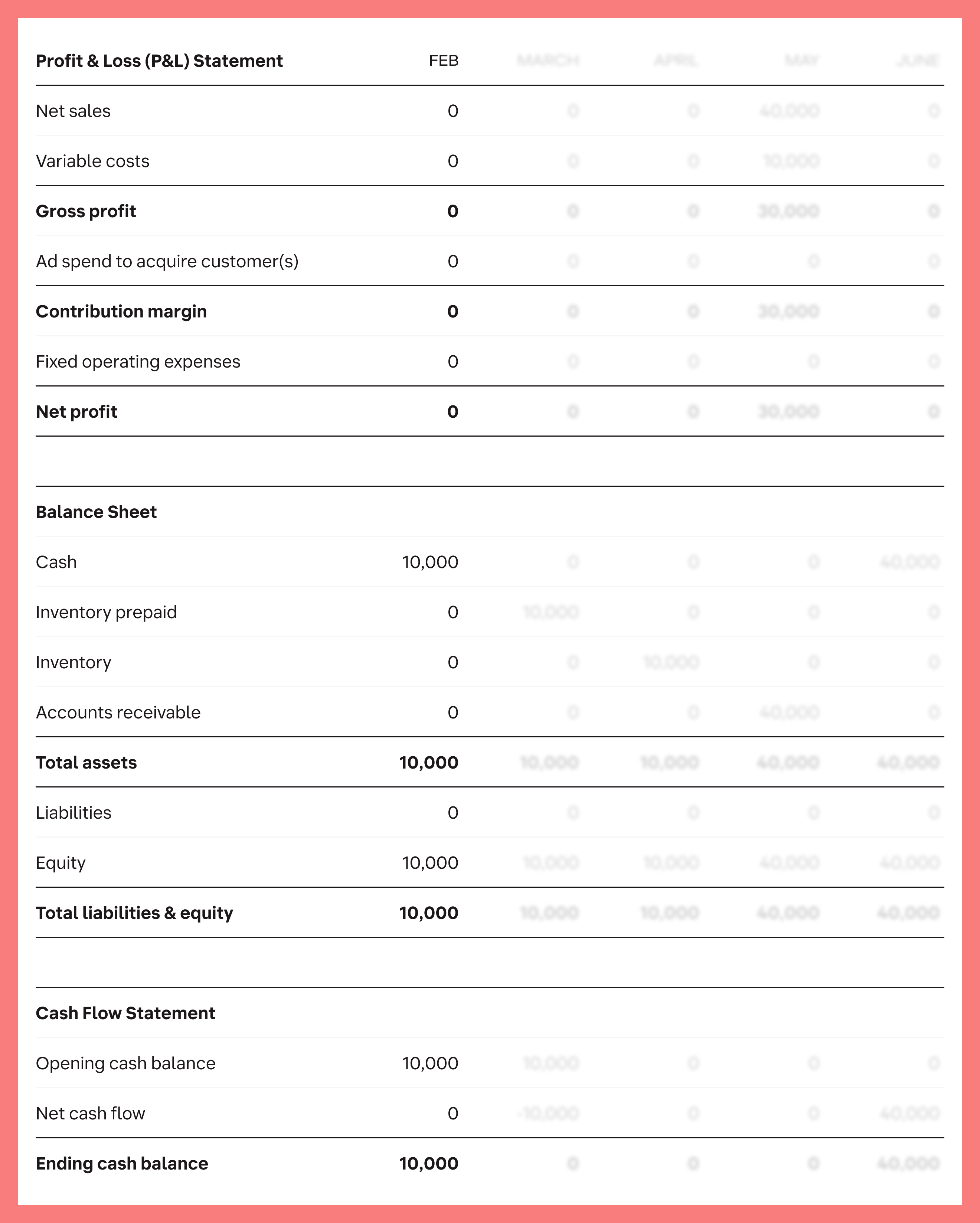

Suppose you have a starting cash balance of $10,000 in February. This is reflected in the "cash" and "equity" figures of your balance sheet.

March begins, and you want to put that cash to work and earn a profit. You purchase $10,000 of inventory for your Amazon store on the 1st March.

The cash leaves your bank account to pay the supplier, but there's no immediate impact on the P&L.

Over on the balance sheet, the "inventory prepaid" asset increases by $10,000 and your cash balance decreases by the same amount. The cash is effectively "tied up" in inventory until it's sold, and your cash balance is now zero.

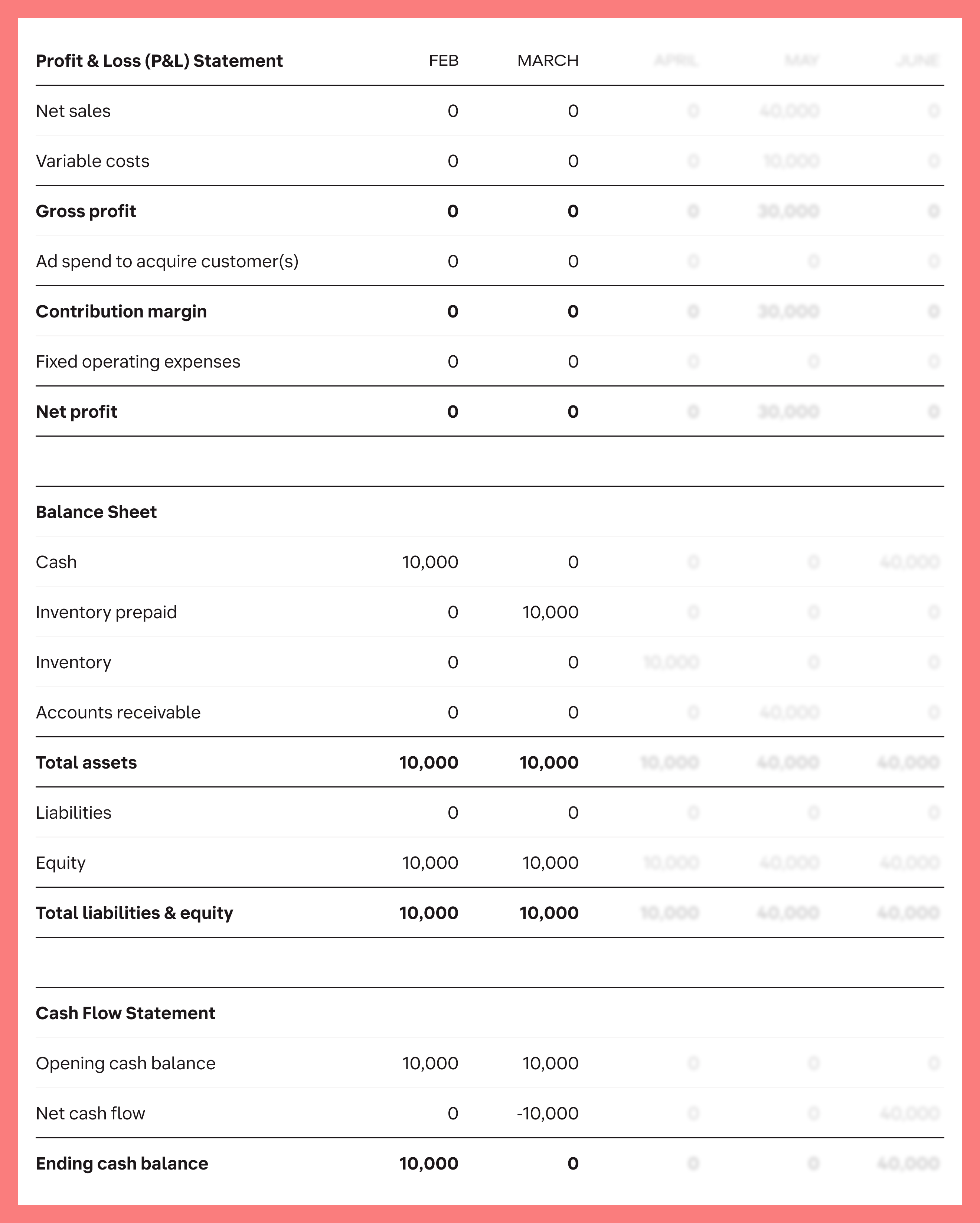

After 2 months of waiting, your inventory arrives from China on the 31st April and you mark it "in stock" on Amazon.

Your "inventory prepaid" has been capitalized as "inventory", but no other changes take place in the financial statements just yet.

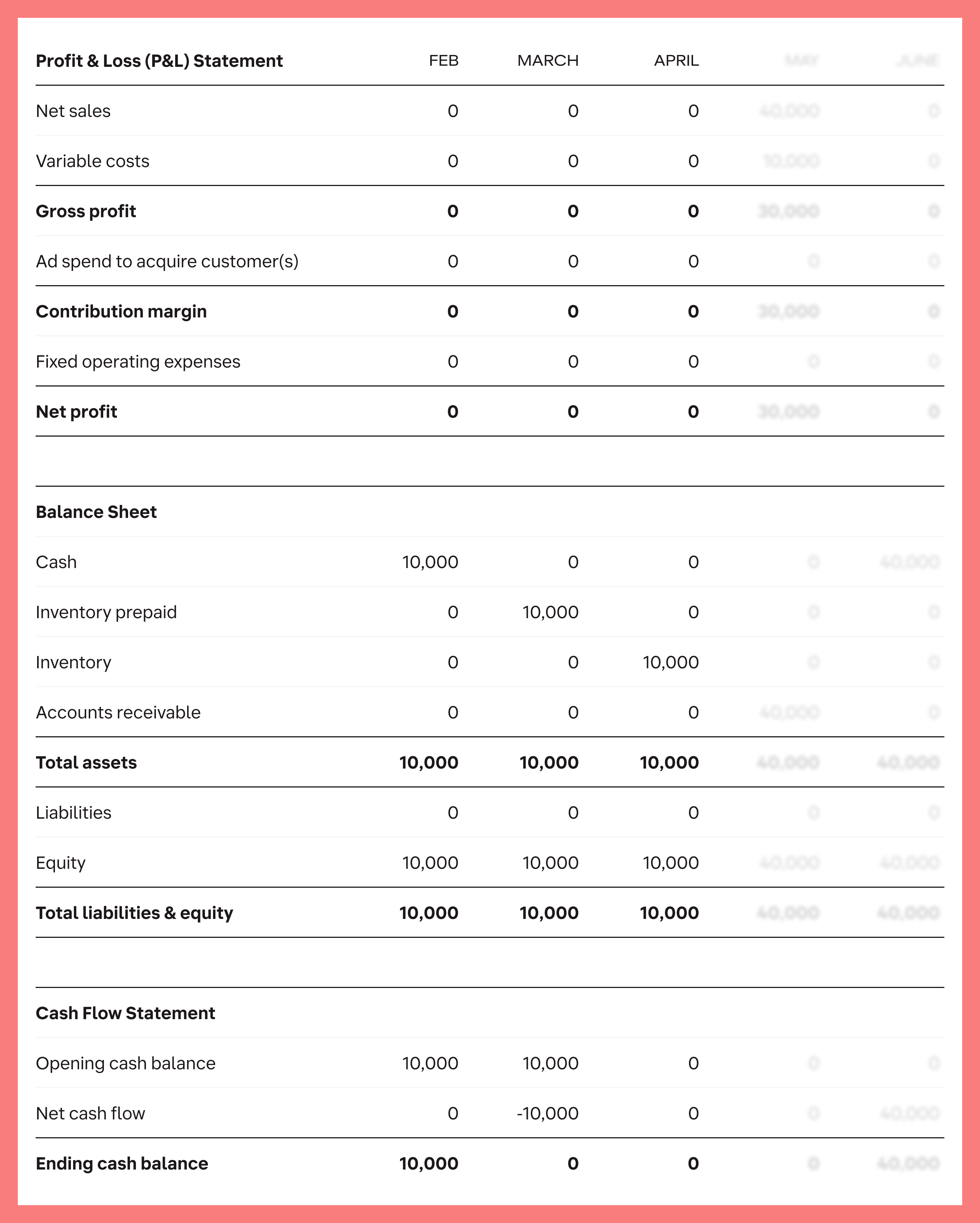

May is when the action happens. Demand for your product is high, so it sells out rapidly, bringing in revenue of $40,000 by the end of the month.

This now hits the P&L statement: $40,000 of revenue, minus $10,000 COGS, leaving a profit of $30,000. Great!

The associated inventory figure in the balance sheet reduces to reflect the sales, but what about your cash balance? Not so fast.

Amazon don't disburse the cash from these sales right away, so let's assume you won't receive it until the beginning of June. While the accounts receivable asset would increase by $40,000 to reflect this, your bank balance hasn't increased yet.

Finally, June comes around and you receive the cash from the sales. This is reflected in your balance sheet and cashflow statement.

The profit you set out to earn from your initial capital of $10,000 at the start of March has finally landed in your bank account, three months later.

Of course, the above example is a huge oversimplification. It assumes your only cost is inventory, ignoring line items like delivery costs, fulfilment fees and fixed operating expenses.

This omission leads to a net margin of 75%, which is huge for a consumer product. It also deals with a single inventory order in isolation, when in reality, your business has multiple transactions like this stacked on top of one another.

But looking at a simple example like this really illustrates how a cashflow squeeze arises even when you're selling a profitable product with strong demand.

While this inventory cycle did generate profits for the business, the initial $10,000 cash outflow on the 1st March wasn't recouped until the 1st June!

For argument's sake, imagine this $10,000 was all the business had in the bank on 1st March, effectively leaving a balance of zero for months.

How would they pay the wages for March, April and May? How would they keep the office lights on? How would they invest in new product lines? In short, they wouldn't. The business would die.

Your business is more complex than this example, which can make it even harder to see what's truly happening to your cash position over time.

That's why looking at the cashflow statement is so important to assess the health of a business. You don't die in your P&L. You die in your cashflow statement.

Get a financing offer

It takes less than 10 minutes to submit an application.